20230331 - Roof Rule Changes - Public

Carousel News

Personal Lines Bulletin

Menú de navegación

Ruta de navegación

Dynamic Header

Personal Lines Bulletin

Publicador de contenidos

To comply with legislative changes enacted by Senate Bill 2-D, Citizens’ roof rules will be updated effective May 1, 2023, for new business and September 1, 2023, for renewing policies. The changes are:

- Remaining Useful Life: Risks that do not meet the roof replacement eligibility requirements may be eligible for coverage by submitting acceptable documentation verifying the roof has remaining useful life. The eligible minimum will be updated from three years remaining useful life to five years remaining useful life on roofs that exceed the maximum age.

- Age: In situations where the entire roof is not replaced at the same time, the roof age will be based on the oldest part of the roof.

- Coverage Extensions: For roofs that qualify, coverage will be extended for a period of up to five years even if the remaining useful life shown on the inspection is greater than five years. Citizens may conduct inspections at any time to verify that the roof continues to satisfy underwriting requirements.

- Condition: The condition rule citing excessively patched areas will be revised to remove the 25% reference.

Note: Regardless of the inspection result, five years is the maximum allowed.

Roof Required Documents Reminder

As announced in the Personal Lines Bulletin: Required Document Updates for New-Business and Roof Eligibility, Citizens has updated the required documents for proof of roof replacement and roof remaining useful life for risks with roofs to align with the roof rule changes:

- Older than 25 years for shingle and other types of roofs (soft)

- 50 years for tile, slate, concrete or metal roofs (hard)

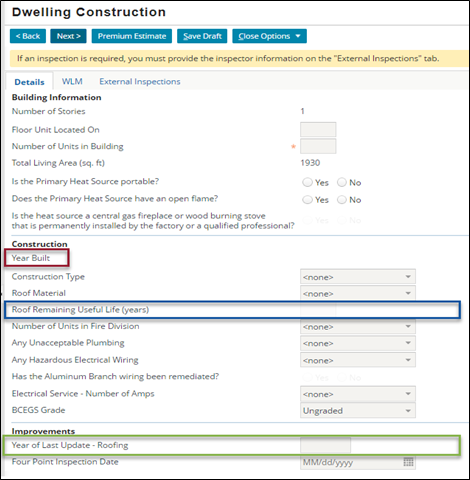

The fields outlined below are located on the Dwelling Construction screen in PolicyCenter®.

Figure 1: Dwelling Construction screen

Home/Dwelling is less than 25 or 50 years

Roof Remaining Useful Life (Years)The Roof Remaining Useful Life (years) field will be grayed out (blocked) as the roof remaining useful life is not required because of the age of the home/dwelling and no documentation is required.

Home/Dwelling is more than 25 or 50 years

If the roof has not been replaced or replacement is unable to be verified, enter the remaining useful life according to the 4-Point Inspection Form or Roof Inspection Form. Please note the maximum value allowed is five years. The system will submit the risk unbound.

Required Documentation

- 4-Point Inspection Form showing at least five years of remaining useful life

OR

- Roof Inspection Form showing at least five years of remaining useful life

PolicyCenter will automatically

Submit risk unbound to Underwriting for approval

Home/Dwelling is less than 25 or 50 years

Year of Last Update - Roofing The Year of Last Update – Roofing field is not required. If a value is entered in the field, regardless of age, required documentation must be submitted

Home/Dwelling is more than 25 or 50 years

If the roof has been replaced and you have the proper required documentation, enter the year of roof replacement in this field to bind the risk.

Required Documentation

- Finalized roof permit

OR - Paid-in-full roofing contract, work order or receipt

PolicyCenter will automatically

Allow coverage to be bound by agent*

*Provided there are no other factors requiring the risk to come in unbound

Resources

For more information regarding these changes, log in to the Agents website:

- Go to the Personal section.

- Click on PR-M or PR-W.

- You can then view the updated required document guides and product guides by policy.

Credentialed agency staff can log in to the Agents website and select Training; locate the Spotlight section; and in the Resource section, access the following:

- Home Condition Requirements

- Mobile Home Condition Requirements

- New Business Eligibility Guide

- Five Things You Need to Know About Citizens: Eligibility & Roof Replacement Requirements recorded webinar

Legal Disclaimer

Citizens provides agent communications online for historical purposes only, and the communications have not been updated to include any changes that may have been made after publication. Agents can find the latest information by reviewing the applicable underwriting manuals, and by logging in and accessing our FAQs, which are available from the top of any page on our website.

Mobile Header - Spotlight

Spotlight

Publicador de contenidos

Email Distribution for Agent Bulletins

Get Agent Bulletins

Email Distribution

Manage your Agent Bulletin preferences. Subscribe or unsubscribe with a single click.