20231009 - Rate and Form Changes - Public

Carousel News

Personal Lines Bulletin

Navigation Menu

Breadcrumb

Web Content Display (Global)

Personal Lines Bulletin

Asset Publisher

The Florida Office of Insurance Regulation (OIR) approved updates to Citizens’ Commercial Lines policy rates and forms, and the changes are outlined below. Agents also will be able to view the rating worksheets and factors in PolicyCenter®.

Form and Rate Changes: November

- The assessment warning statement has been updated on the Declarations page for new and renewal policies, effective November 1, 2023.

- Effective November 20, 2023, all Commercial Lines policy premiums will increase an average of 10.2%.

Form Changes: December

These form changes apply to new and renewal policies, effective December 1, 2023:

- Commercial property deductible endorsements:

- Florida calendar year hurricane percentage deductible (residential risks)

- Florida hurricane percentage deductible – each hurricane (residential risks)

- Windstorm or hail percentage deductible

- Florida changes – cancellation and nonrenewal:

- Verbiage that referred to policies in effect for 90 days or more now reflects policies in effect for 60 days or more.

- Verbiage referring to “contents” has been updated to “residential property.”

- Additional verbiage was added to refer to specific coverage scenarios.

- Other endorsements

- Cause of Loss – Windstorm or Hail Form (CIT-W10-10)

- Windstorm or Hail Exclusion

- Windstorm Protective Devices

Note: Citizens now accepts e-signatures for the windstorm and contents coverage exclusion forms.

- Notice of Change in Policy Terms:

- The Notice of Change in Policy Terms applicable to the specific commercial policy form details all of the changes that have occurred for that specific policy form.

- Definitions change

- The definition of “hurricane occurrence” is amended to “hurricane,” and the duration of a “hurricane” is amended to start at the time a hurricane warning is issued for any part of Florida by the National Hurricane Center of the National Weather Service.

- A definition of “hurricane deductible” is added to express that a hurricane deductible is applicable to a loss caused by a hurricane if hurricane coverage and a hurricane deductible are provided in your policy.

- Under the Claim, Supplemental Claim or Reopened Claim policy condition:

- Paragraph 3 is amended to read:

- For claims resulting from ‘hurricane(s), tornadoes, windstorms, severe rain, or other weather-related events, the date of loss is the date that the ‘hurricane’ made landfall or the tornado, windstorm, severe rain, or other weather-related event is verified by the National Oceanic and Atmospheric Administration.

- Amendments are added to the policy condition’s timelines of a named insured who is a service member (as defined in Section 250.01, Florida Statutes) during any term of deployment to a combat zone or combat support posting that affects the ability of the named insured to file a claim, supplemental claim or reopened claim.

- Paragraph 3 is amended to read:

- The state of emergency cancellation and nonrenewal provision is amended to reflect that Citizens may not cancel or nonrenew a commercial residential policy for a period of 90 days after the covered dwelling or covered residential property has been repaired if such property has been damaged as a result of a hurricane that is the subject of a declaration of emergency.

- A provision is added stating Citizens may not cancel or nonrenew a commercial residential policy until the earlier of when the covered dwelling or covered residential property has been repaired or one year after we issue the final claim payment, if such property was damaged by any covered peril, other than damage from a hurricane.

- The Commercial Lines assessment language for the Premium Estimate (quote) on the Declarations page has been updated to read: Warning: Premium presented could increase if Citizens is required to charge assessments following a major catastrophe.

Note: Rule changes were announced in June’s Commercial Lines Bulletin: Underwriting Rule Changes.

PolicyCenter

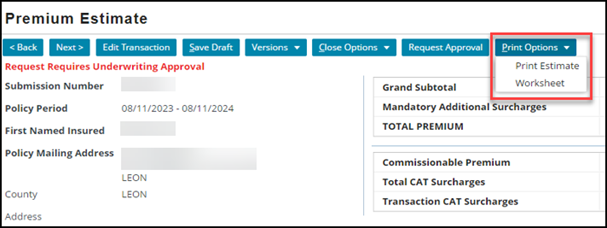

Agents are now able to view and print the Commercial Ratings Worksheet, which will provide details on how Citizens arrived at a rating decision. The ability to print the rating worksheets will not include A-Rates or Builders Risks policies.

Agents can now access the Worksheet printing option on the Premium Estimate screen.

Figure 1: Print Options on the Premium Estimate screen

Resources

Log in to the Agents site:

- Go to the Commercial section, click on the appropriate policy type on the left-hand side of the page, and select:

- Manuals for rating steps and factors from the center menu

- Rating Worksheets from the center menu

- Charts for Rate Changes by Territory from the right-hand side column

- Go to the News page and select Bulletins > Commercial Lines to view the Commercial Lines Bulletin: Underwriting Rule Changes sent on June 30, 2023.

- Go to the Training page and select Commercial Job Aids > New Business to access the Commercial Lines New-Business Submission Guide and Uploading and Linking Documents.

- Go to the Training page and select Commercial Job Aids > Training > Commercial Lines to access the Commercial Lines Resources Guide.

Legal Disclaimer

Citizens provides agent communications online for historical purposes only, and the communications have not been updated to include any changes that may have been made after publication. Agents can find the latest information by reviewing the applicable underwriting manuals, and by logging in and accessing our FAQs, which are available from the top of any page on our website.

Web Content Display (Global)

Spotlight

Asset Publisher

Email Distribution for Agent Bulletins

Get Agent Bulletins

Email Distribution

Manage your Agent Bulletin preferences. Subscribe or unsubscribe with a single click.