We are undergoing an extended maintenance outage from 6 p.m. ET Thursday, May 15, through Sunday, May 18 for PolicyCenter® and ClaimCenter®; myPolicy will be unavailable starting 4 p.m. During those times, PolicyCenter and ClaimCenter will be in view-only mode. The One-Time Payment option and Pay-by-phone at 866.411.2742 will be available. Report a loss by contacting our 24/7, toll-free Claims Reporting Center at 866.411.2742. We apologize for any inconvenience.

Alerts

20230123 Flood Insurance Requirements for Citizens’ New Business - Public

Carousel News

Personal Lines Bulletin

Navigation Menu

Breadcrumb

Web Content Display (Global)

Personal Lines Bulletin

Asset Publisher

Citizens is updating our eligibility rules to comply with Senate Bill 2-A, passed by Florida legislators during the December 2022 Special Session. This communication covers new business only. We will send information about renewal at a later date.

All personal residential new-business applications effective on or after April 1, 2023, that include wind coverage and are located in the special flood hazard area, as defined by the National Flood Insurance Program (NFIP), now are required to have flood insurance.

Additionally, all customers impacted by this new rule will be required to sign a Policyholder Affirmation Regarding Flood Insurance (CIT FW01).

Coverage Requirements

Under the new rule, a new-business applicant located in a special flood hazard area is required to secure flood coverage from the NFIP or a private insurance carrier at the following limits:

- Dwellings: Equal to or greater than Citizens’ separate Coverage A and Coverage C limits

- Condominium or unit-owners: Equal to or greater than Citizens’ separate Coverage A and Coverage C limits

- Tenant contents: Equal to or greater than Citizens’ Coverage C limit

- Cooperative unit-owners: Equal to or greater than Citizens’ Coverage C limit

If the above limits are not available from the NFIP, Citizens will accept the maximum coverage amount for which the insured is eligible. Maximum NFIP limits:

- Regular Program: $250,000 Coverage A, $100,000 Coverage C

- Emergency Program: $35,000 Coverage A, $10,000 Coverage C

New-Business Process

For policies effective April 1, 2023, and later, you will be prompted to add the flood information when completing the application and will be required to upload two required documents.

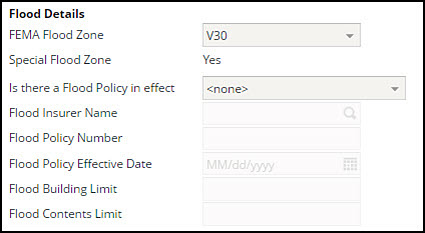

Figure 1: Flood Details on the Property Address Info screen

Required Documentation

To demonstrate compliance with the flood requirement, all new-business applicants meeting the conditions above are required to submit both of the following documents:

- A completed Policyholder Affirmation Regarding Flood Insurance (CIT FW01)

- Proof of flood coverage, which can be any of the following:

- If an application for flood coverage is pending, a copy of the submitted application and proof of payment as initial proof of compliance

- A copy of the flood policy declarations

- Citizens’ Wind Only Policies: Proof that the customer has a flood endorsement that meets the minimum standard on their underlying multiperil policy

Notes

- PolicyCenter® will soon be updated to reflect the flood insurance requirements.

- The website, job aids and underwriting manuals will be updated as soon as possible.

- Policies with windstorm or hail coverage excluded are not required to purchase flood coverage.

- Risks ineligible for an NFIP flood policy may be eligible for a Citizens policy excluding wind coverage.

Learning Opportunities

Agents and credentialed agency staff can register to attend a free webinar, 2023 Personal Lines Flood Insurance Requirements, on January 31 or February 2. Log in to the Agents site and select Training > Live Education, and then select the appropriate link to register.

Citizens Live Webinars

| Topic | Date and Time | Location | Registration Link |

|---|---|---|---|

| 2023 Personal Lines Flood Insurance Requirements | Tuesday, January 31 10-11 a.m. |

Zoom | Register Here |

| 2023 Personal Lines Flood Insurance Requirements | Tuesday, January 31 2-3 p.m. |

Zoom | Register Here |

| 2023 Personal Lines Flood Insurance Requirements | Thursday, February 2 10-11 a.m. |

Zoom | Register Here |

| 2023 Personal Lines Flood Insurance Requirements | Thursday, February 2 2-3 p.m. |

Zoom | Register Here |

Resources

Agents and consumers can visit FloodSmart.gov for information about flood insurance and finding a flood insurance provider. Plan ahead as there is typically a waiting period for a flood policy to go into effect.

Log in to the Agents site, and:

- Select Personal > PR-M or PR-W, and then select the appropriate policy type on the left-menu bar:

- The Underwriting Guidelines, Rule 202. Eligibility – Underwriting for Flood Insurance Requirements will soon be updated.

- Look in the Spotlight section on the right side of the page for the Product Guides and Required Document Guides.

- Select Training > Personal Job Aids to access Citizens’ learning resources:

- New-Business Submission Guide

- Policy Change

- Apply Changes at Renewal

- Uploading and Linking Documents

- Look in the Learn More section on the right side of the page for the Product Guides and Required Document Guides

- Select FAQs on the menu at the top of each page. Enter +flood in the Search field.

Legal Disclaimer

Citizens provides agent communications online for historical purposes only, and the communications have not been updated to include any changes that may have been made after publication. Agents can find the latest information by reviewing the applicable underwriting manuals, and by logging in and accessing our FAQs, which are available from the top of any page on our website.

Web Content Display (Global)

Spotlight

Asset Publisher

Email Distribution for Agent Bulletins

Get Agent Bulletins

Email Distribution

Manage your Agent Bulletin preferences. Subscribe or unsubscribe with a single click.